Abstract

Artificial Intelligence (AI) technologies have rewritten how businesses are run in the digital economy as digital has become the default method of interaction for people and businesses. Automation has long been the solution of choice for improving efficiency in Insurance Claims Management. It will no longer do as creeping loss ratios are toppling the profit margins that companies have been safeguarding. Cognitive computing, one of the AI-based technologies is bringing in human-like reasoning, insights, and decision-making at superior processing speeds to Insurance Claims Management. Cognitive computing holds great promise for reinventing insurance business models and catapulting its operational performance, organization productivity, and overall profit margin.

A Retrospect

As a way to indemnify ourselves against potential loss, there is no better alternative to Insurance. The insurance industry has been overly focused on improving underwriting standards and reducing administration costs for long. Claims management has gotten the short shrift until a steep rise in loss ratio and its adverse impact on profit margins started to change that.

Claims management involves various steps from the First Notice of Loss (FNOL), assignment of a claims adjustor, investigation, and claim settlement up to claim payment. It is typically a cumbersome web of processes needing considerable manual intervention. With rising demand from the ecosystem for stringent regulatory compliance and high customer expectations, insurance has tried to automate the manual processes in response. This has cut costs, reduced fraud and improved customer experience, but the benefits have only been incremental.

Automation alone lacks the ability to take the insurance sector to the next dimension of growth unless intelligent decisions can be made quickly without manual intervention. With the emergence of disruptive demographic changes and volatile economies, the huge threat of unexpected financial loss to the Insurance carriers needs to be addressed.

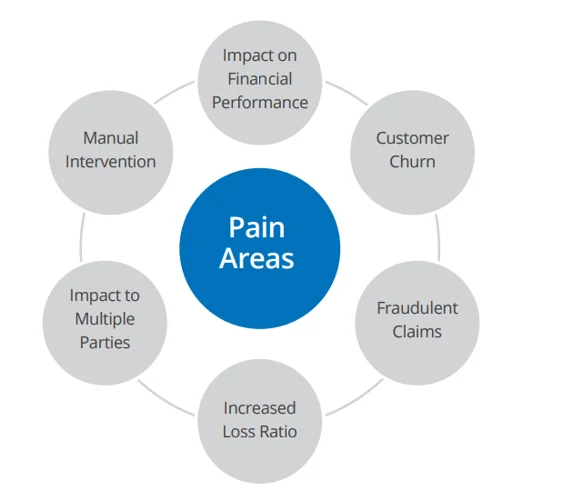

What is Ailing the Current Claims Process?

The current Claims Management Process is riddled with serious pain points. Any new solution that promises transformation needs to address them in depth. It goes a long way in future-proofing the business and uncovering new and exciting business opportunities.

Adverse Impact on Financial Performance:

Any revenue loss arising from higher than the required Claims settlement amount has huge impact on an Insurance carriers financial performance.

Undesirable Customer Churn:

Claim, by its very nature is quite a contentious subject. There are instances of delayed claims settlement, payment of less than the claimed amount or even outright rejection of a claim. This can be a source of disgruntlement and dissatisfaction for the clients and can cause undesirable customer churn.

Inability to Handle Fraudulent Claims:

One of the challenges of the claims adjuster is to determine if the claim is fraudulent. Due to lack of a clear, defensible and structured process/technique to identify such claims, the insurance carriers are left with no option sometimes but to settle the claim. This impacts the insurance carrierȇs financial performance.

Increased Loss Ratio:

Actuaries consider the company loss ratio when determining the premium amount. Hence, the higher the loss ratio, the higher is the customer premium. It is in the interest of the insurance carrier to keep the loss ratio in check in order to be market-competitive.

Impact to Multiple Parties:

An inaccurate or inefficient claims process affects many parties that are involved.

Agents – Agent performance is dependent on the premium to loss ratio of the business booked apart from their customer retention record.

Underwriters – Underwriter performance is based on how risk is assessed. If the number of claims is higher than the norm, there will be a dip in underwriter performance.

Actuaries – Claim losses directly impact premium rates.

Adjusters – Adjusters are involved in claim adjudication and hence, their roles and costs increase based on the frequency & severity of claims.

TPA – If Third Party Administrators (TPA) are involved in claims assessment, they tend to be under pressure to settle the claims quickly.

Customers – Customer is the most affected party and the priority of every insurance carrier.

Manual Intervention

In a typical ‘Claims Settlement’, there tends to be a lot of communication, paperwork, travel, coordination and fees that result in higher administrative costs for the insurance carrier and a higher premium for the customer.

Intelligent and Effective Claims Settlement – The Cognitive Way

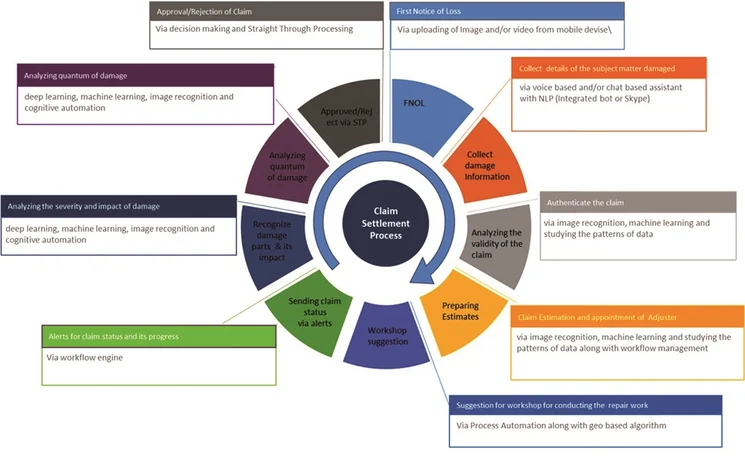

In the Cognitive Computing approach, a judicious combination of human logic and machine-learning are used to great effect. It is supported by intelligent data-driven analysis based on insurance/loss history and outcome prediction resulting in highly effective claim settlements.

As part of the self-learning methodology, the data provided to the system will have the required knowledge to study the patterns, process them with machine learning algorithms and provide the desired output. The use case below describes how precisely cognitive computing can help in effective claim settlement. Imagine a scenario in which a loss has occurred and the claimant is reporting the loss to the Insurance carrier

FNOL by uploading an image or a video of the damaged property.

CSR collects additional information related to the damage using AI-based cognitive virtual assistant (voice-based and/or chat-based assistant with NLP-integrated bot or Skype)

Using image recognition, machine learning and other corresponding data present in the system, the system studies the data patterns and determines (1) the validity and authenticity of the claim (2) the estimated loss so that the right Claims Adjuster is appointed.

The system suggests where repairs can be done by leveraging geo-based algorithms.

After the adjuster/surveyor is appointed, a workflow Will be initiated Where automated emails/alerts/messages will be sent to the claimant regarding the claim status and the adjuster contact details.

Drawing on deep learning, machine learning, image recognition and cognitive automation, the system will recognize the damaged parts, extent of damage, potential impact of the damaged area and determine if the claim should move to the next step or rejected.

If rejected, the claimant will be communicated accordingly via an automated email/alert

If approved, the system will communicate the approved claim amount based on the decision-making module.

By leveraging machine learning, a rich set of business rules & a workflow engine, the system will settle the claim via STP and issue the claim cheque.

Cognitive computing in Insurance, especially in the claims settlement process brings a highly effective solution to end-to-end claim processing raising operational efficiency along with the prospect of efficient AI-based prediction and self-remediation.

It also enables smarter and faster decisions allowing Insurance carriers to predict and prevent problems so that they can reap huge cost savings With a positive impact on their financial performance.

AdfarTech at the Vanguard of Cognitive Computing Excellence:

AdfarTech has a proven track record of a series of successful implementations of Cognitive computing for many insurance clients.We offer:

Rich automation capability to make insurance business processes more customer-centric, optimize cost, and improve operational efficiency in the areas of underwriting, Claims submission, Claims settlement, and Payment.

Extensive self-learning experience via AI-based prediction and self-remediation.

Intelligent automation via STP to make sound underwriting decisions and claims amount approvals.

Customized platform with AI-based business digital assistant to issue automated responses from business functions such as claim status, information policies, and sales trends.

Multi-channel experience that can extend to multi-currency and multi lingual scenarios

End-to-end process automation using image recognition, chat bots/virtual assistants, workflo management, and analytics/insights

Smart decisions in the insurance policy life cycle by using leading cognitive technologies such as Machine Learning, Deep Learning, RPA, and OCR

NLP and AI to directly connect customers with their individual portfolios in answering FAQs, building scenarios, and offer comparative analysis.

Connected devices to mitigate risk, explore new business models & value chain processes.

APIs for seamless integration with the stakeholders.

Advanced analytics to provide personalized offerings and improve underwriting claims operations.

Cut the Red Tape and Transform Insurance with Cognitive Computing

The industry is relentlessly marching towards cognitive computing worldwide and the Insurance sector is at the forefront. Cognitive computing in effective Claims Management is making a huge difference to insurance carriers. With the help of machine learning, deep learning, image recognition, reasoning and many other intelligent & cognitive automation technologies, cognitive computing is enabling smarter and faster decisions. It is making it possible to predict and prevent problems leading to faster complex and ambiguous task execution with high accuracy. Faster time-to-market, higher agent effectiveness, lower customer acquisition costs, improved sales, and enhanced delivery on the interaction and customer experience are the new realities for the insurance industry.